As described on a previous post, logistic growth models can be used on evaluating growth stocks. Tesla would be a perfect example for applying this model, as Tesla is a fast growing company with already a record of business activities over the last years and a more or less predictable business model.

First I want to state that I have been a fan of Tesla since my first ride on a Model 3 a few years ago. If I hadn’t the possibility to invest in the stock market I already might have bought myself one.

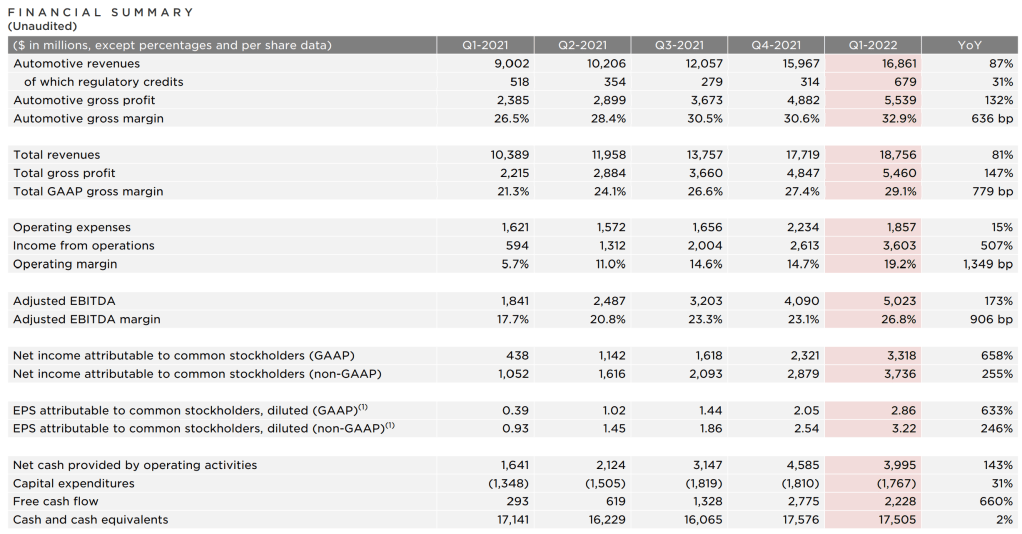

Now, let’s evaluate the company. First, lets look at the current numbers as a basis for my growth-model.

(From the Q1 2022 report)

I took all necessary data and put it into my model, as seen on the next chart.

This was the easy task. In the next step our brain needs to get out from idle mode. We have to construct the future of Tesla in our imagination. It is not possible to do this step without being mentally biased. Therefore, it is useful to look for information that is contrary to your opinion.

I can think of the following future-state-scenarios:

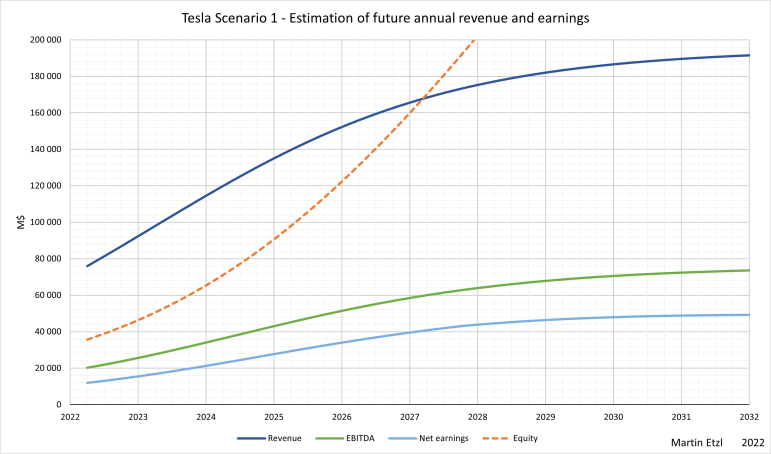

Scenario 1:

The Tesla-fan-community has a strong belief in the long term prospects and a high stock price is maintained. The high stock price is justified by a net profit of 50 B$, which is mainly due to new business models and new technology. The automotive business will only contribute a small portion to the earnings. The market capitalization is at 1T$ and the P/E-ratio at 20. Tesla shareholders, which invested in 2022 at a price of 1T$ didn’t make any gains at all. However, Tesla is starting to distribute dividends and shareholders are pleased to earn 3% dividend yield.

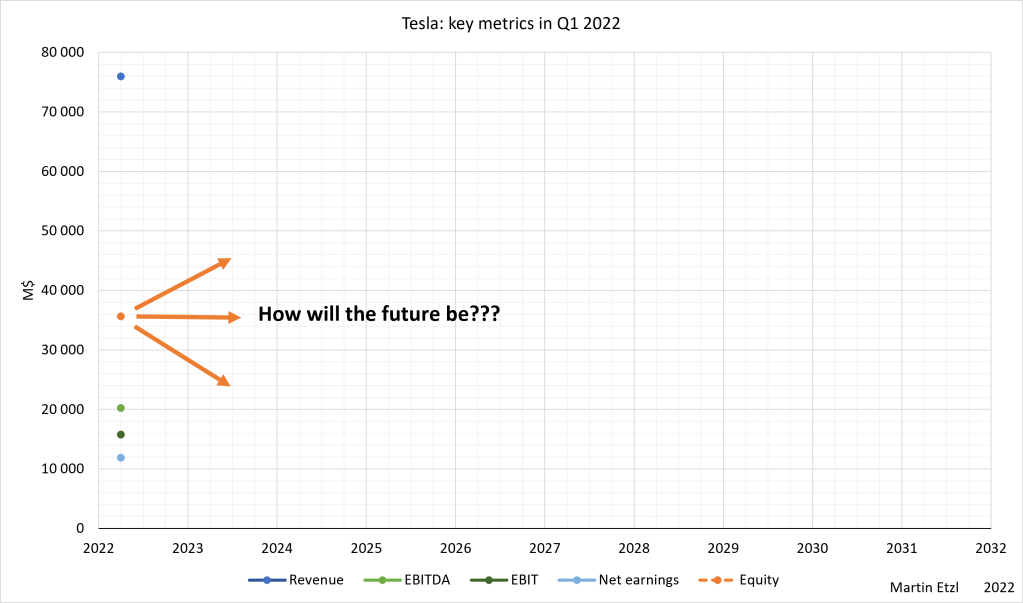

Scenario 2:

Tesla manages to establish a high profitable car business. Compared to competitiors, the high technological advantage and the reputation keeps the prices of the cars high. The integrated business-model with insurance, home solar panels and the autonomous driving software is a success. The operating margin is higher than 15% (which is magnificent) and the market share of Tesla in the global automotive market is at 6%, resulting in 180B$ net sales. Net earnings reach a ceiling of 25B$. Meanwhile, Tesla shareholders had to admit that the company was overevaluated in the past and now has deteriorated to a more decent evaluation of 500B$ with a P/E-ratio of 20.

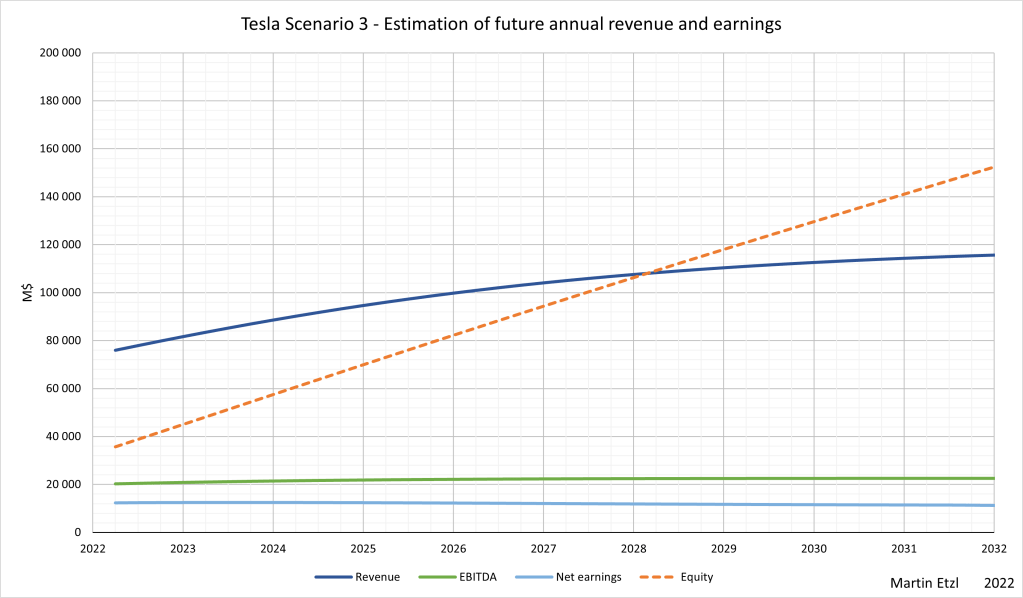

Scenario 3:

Tesla is facing the reality in the automotive market. Competition in the electric car sector puts pressure on sales and in order to utilize its Giga-factories, Tesla has to decrease the prices of its models. However, the company still has an technological advantage and can maintain a high profitability. The annual sales is at 120B$ and the net profit at 12B$. The other businesses of Tesla are also succesful and contribute to its profit (even though the profit might be just a small portion of the total profit). Shareholders now see the company as a innovative car manufacturer with interesting supplementary business models. The market capitalization has plummeted to a value of 180B$, resulting in a P/E-ratio of 15.

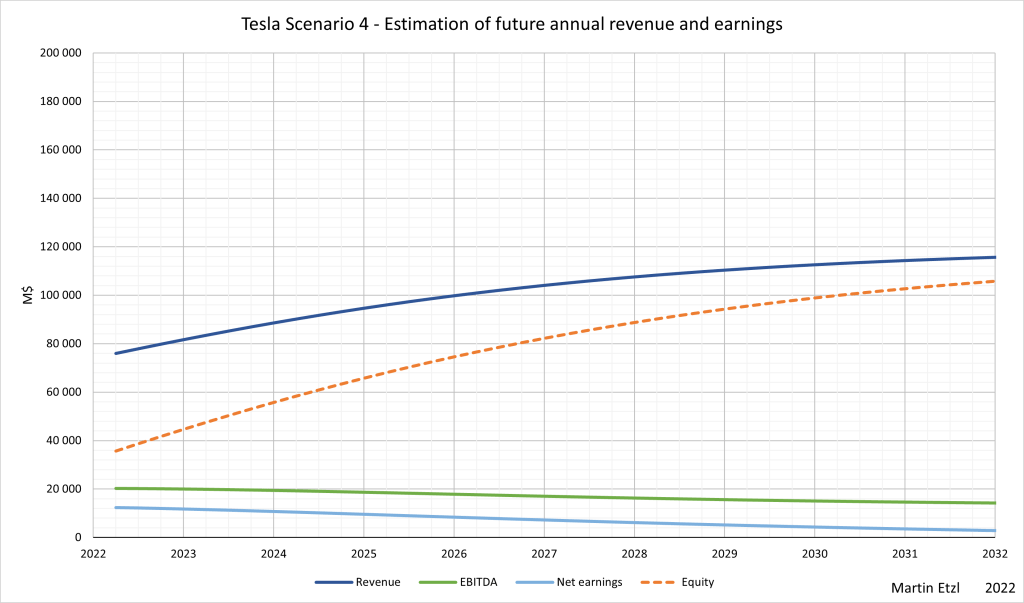

Scenario 4:

As Tesla has become an incumbent, it had to change its production strategy to maintain its sales, now at 120B$. The customers demand more variety in Tesla’s product portfolio and so, Tesla loses efficiency. Tesla has to compete with numerous other car manufacturers. As Teslas other business branches are not as successful as previously believed, Tesla has to focus most of its energy on improving its car business. The operating profit is at mediocre 7% and its net earnings are at 6B$. Many shareholders lost it’s trust, as they saw the market capitalization plummeting from 1T$ to 90B$. Tesla has a solid balance sheet with no long-term debt and is prepared for carry on its investments in future technology.

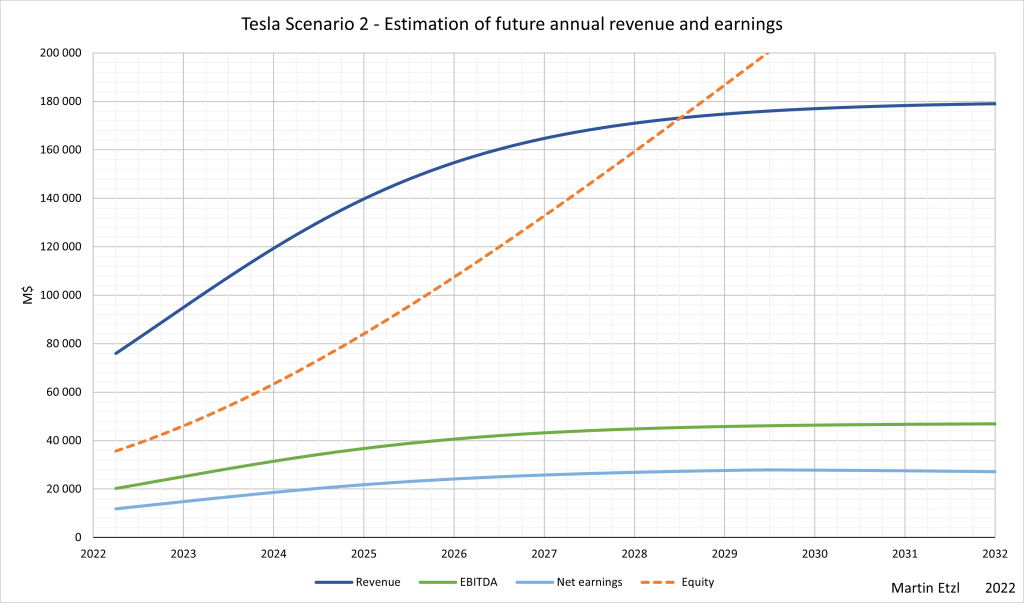

So, these are the scenarios I can think of. Maybe you can think of better scenarios than me, because you have an edge over me in terms of knowledge and information. Normally, two scenarios, a good one and a bad one is enough for making a decent evaluation (It is more important to look for information in order to fill these scenarios).

We can see, that even the brightes scenario of all gives us just a little return. The high evaluation of Tesla makes it very unattractive to invest. Tesla was a ten-bagger in the past, but will never be another ten-bagger at today’s evaluation of an incredibly high one trillion $. A ten-bagger in the other direction would be much more probable, leaving many sanguine investors in desperation.

Do not understand me wrong, the story of Tesla is wonderful and its prospects for the future are good, however it’s evaluation ran too far away from the fundamentals.

Investing in Tesla or not?

In my opinion, scenario 3 is the most realistic on, which would lead to a 80% decrease in Teslas market value. Therefore, I decide not to invest in Tesla. I am going even further and buy myself a short certificate, where I will benefit from price drops. As going short is very risky, I do it only on very obvious over-evaluations and with limited capital. I will observe the share price from time to time for the next years and will sell my short certificate as soon as the evaluation declines to more decent levels. Maybe 500 B$ is a good level to exit.

Did the logistic growth model help me in the decision making?

I could have argued the following without using models: I think Tesla will reach annual sales of 120B$ with a net profit margin of 10% which should be honored by the market with an evaluation of 200B$. This would have saved me a lot of time, however with the scenarios and the graphs as a visual aid, it is easier to imagine the future development. Furthermore, with the model I was forced to do a lot of research, which I might not have done without the model.

Update 2022-10-24

I didn’t expect the price of Tesla falling this fast. After a nice 90% return, I just sold my Tesla short certificate. In my point of view, there is still potential for another price drop. However, the risk for a recovery is high, as Tesla continues the success-story.

Update 2023-08-26

This year was not good for short-selling Tesla. After the stock price rose to 215$, I went short again. Unfortunately, the price soared to 290$ and my knock-out-certificate hit the strike price. I should have known better that a 35% margin of safety might not be enough, when dealing with a highly volatile stock.

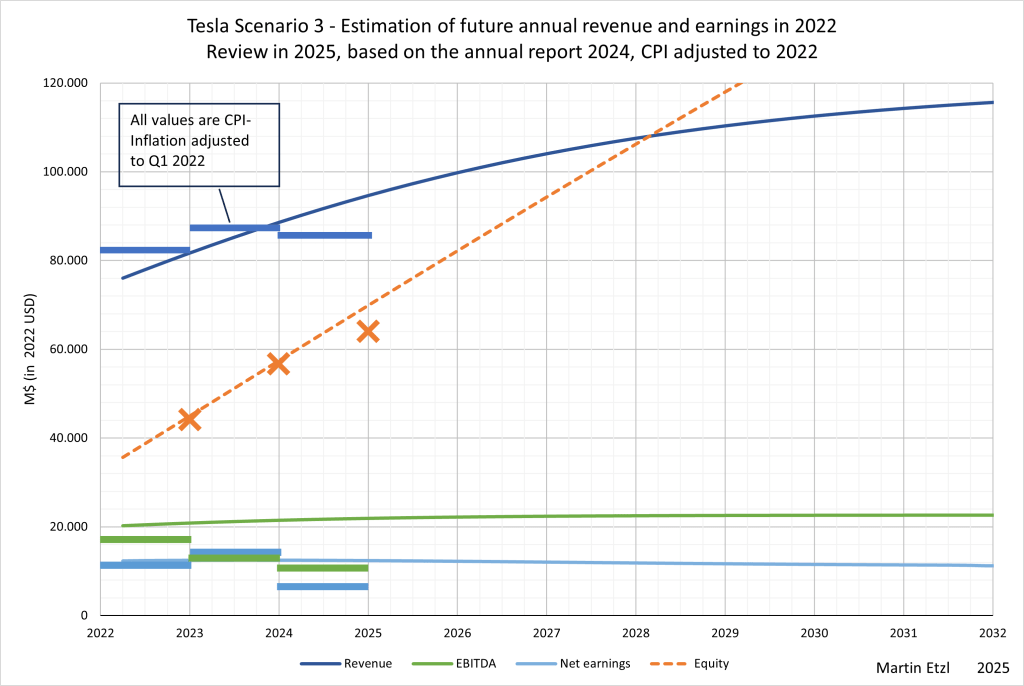

Review 2025-03-02

Here is a comparison of the reported numbers until end of 2024 with the scenario 3 forecast from Q1 2022.

(The bars and crosses represent the actual values (inflation adjusted))