The PEG-ratio (Price-Earning-Growth-Ratio) is a common ratio for evaluating stocks and is very easy to calculate (by dividing the current P/E-ratio by the expected earnings-growth rate in percent). This ratio can give you a quick insight, whether a growth company is over- or undervalued at the stock market. Many people believe that a PEG ratio smaller than 1 is an indicator of a undervalued stock and a PEG ratio higher than 1 is overpriced.

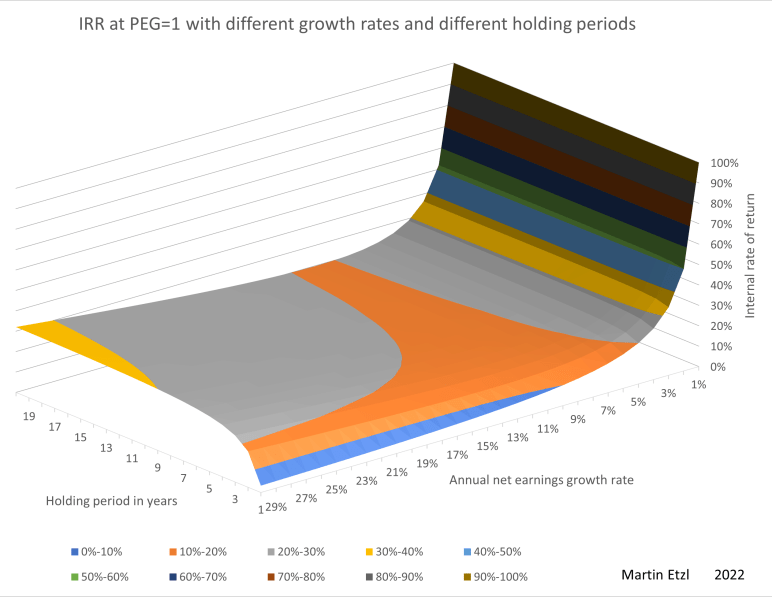

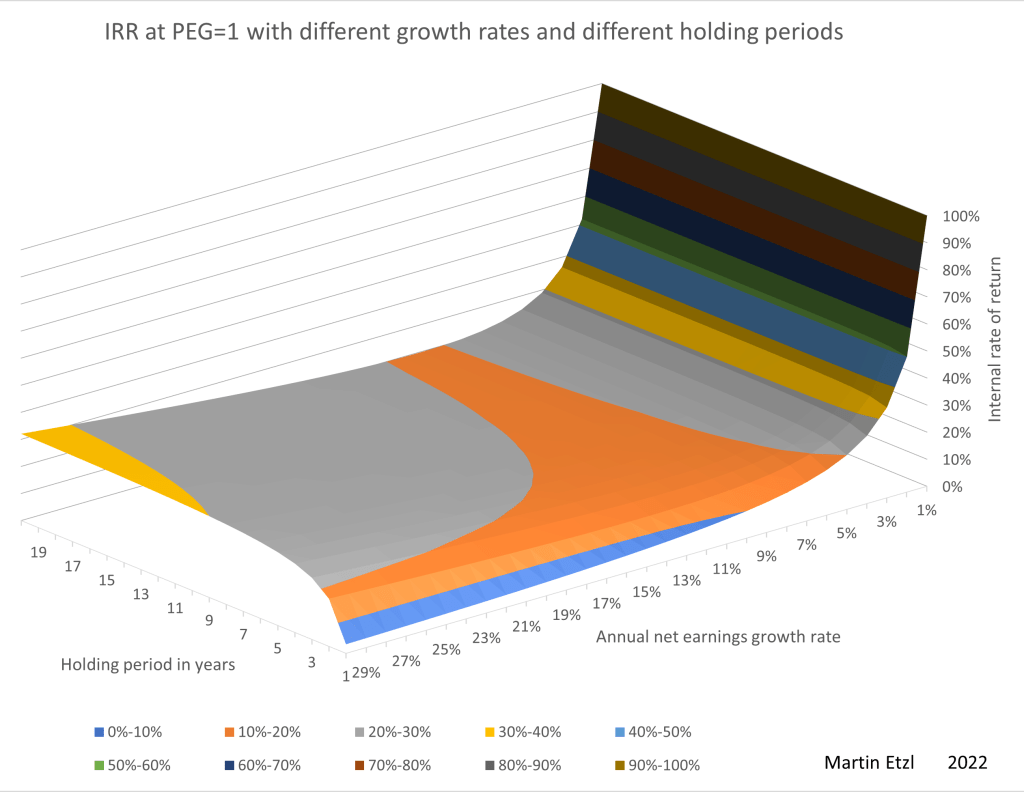

I do not rely on this number when making a decision. One reason is, that PEG is mathematically inacurrate. To give you a better understanding, here is an example: We have 30 stocks on our watchlist and all of them have a PEG ratio of 1. Let’s assume that the growth rate is consistent over the next years. The first company has a growth rate of 1% (and with PEG=1 a P/E of 1), the second has a growth rate of 2% and so on. The next assumption is that we buy the stock now at a PEG of 1 and it can be sold at PEG of 1 anytime in the future. Now, lets calculate the IRR (Internal rate of return). In the following graph 1, you can see a 3D-graph with the IRR at different growth rates and holding periods

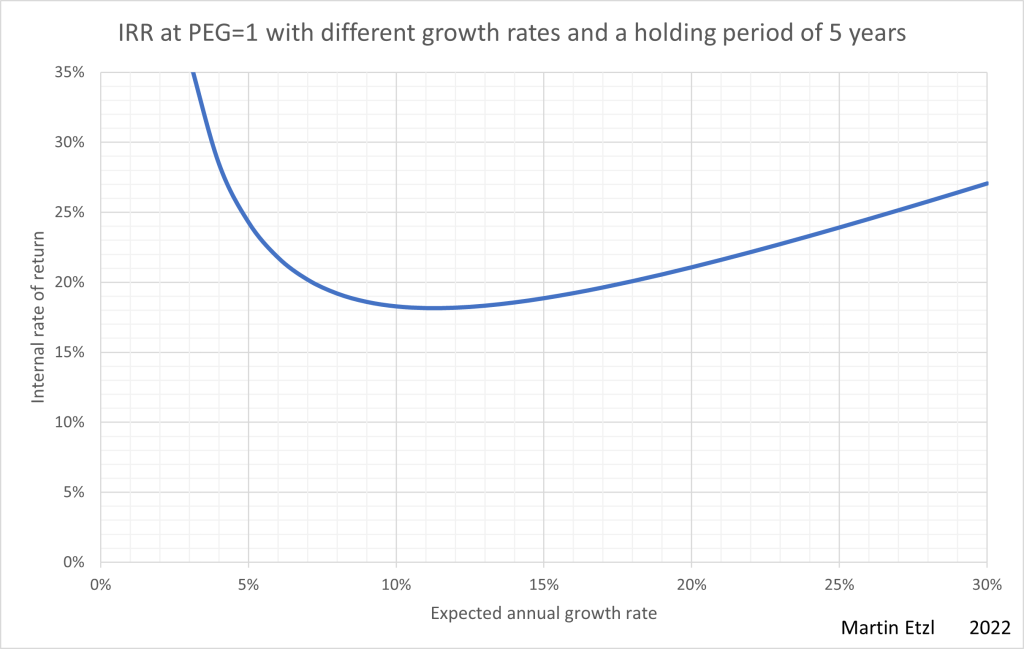

In graph 1 you can see that the IRR is not constant, which implies that the PEG-ratio is no reliable parameter to predict the future returns. Graph 2 shows the function at a holding period of 5 years. So, the same PEG-ratio at 10% growth-rate results in 18% IRR while at 5% growth-rate it results in 24% IRR.

Another disadvantage of PEG is, that the assumption is that there is endless and constant growth rate (=exponential growth), which just isn’t realistic in our world. A better model for growth would be a logistic growth function. The logisitc growth curve can be seen in many natural processes, for example in the growth of bacteria on a petri dish. (For further information on logistical growth, visit my post about logistical growth)

To sum it up, the mathematical error is huge and therefor the PEG-ratio is not a good ratio. However, the far bigger problem is the uncertainty in our assumptions to predict the future.