We all look at growth rates, when evaluating the prospects of a business or a market. It helps us to better estimate, what we are willing to pay now, in order to reach the “sweet fruits” in the future. Very often, NPV (net present value) calculations are a good method for the evaluations. However, it is not enough to do a NPV calculation with constant growth rates.

In this article, I want to introduce to you the method of logistical growth models, I use for evaluating the financial development of growth companies. Logistical growth can be observed in many natural processes, where there is exponential growth with a resource limitation. One example for the logistic function is bacteria growth on a petri dish.

The logistic growth model requires many assumptions on the future (these assumptions have to be made anyway, when doing proper analyses).

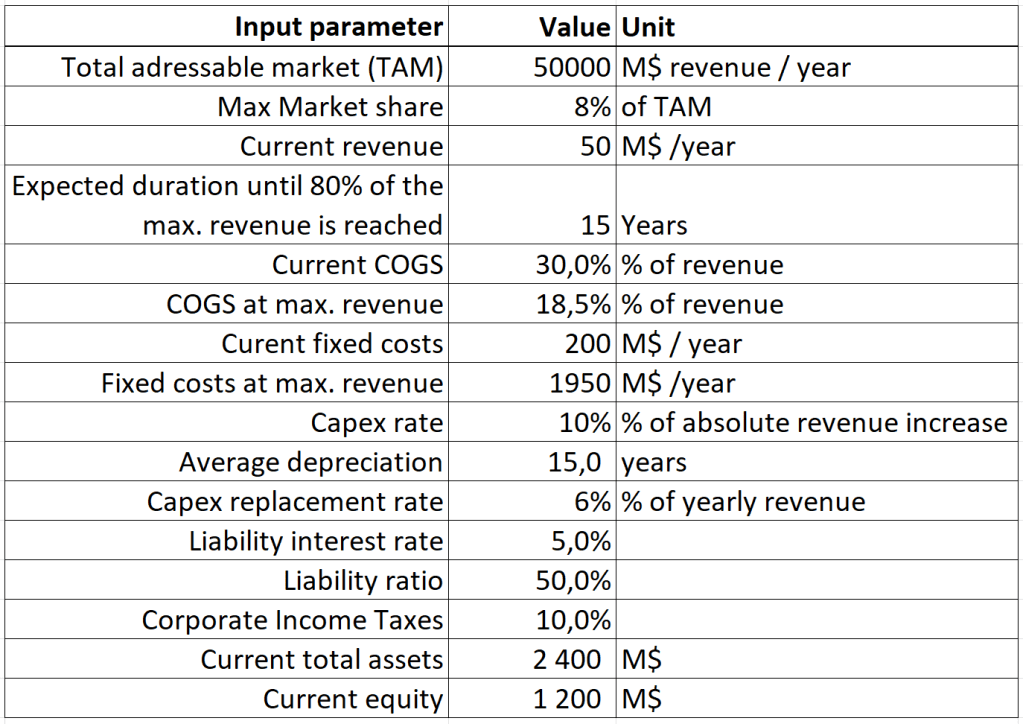

Here is a list of parameters, my model needs to be feeded with:

I do not include inflation effects in my model to decrease complexity of the calculations.

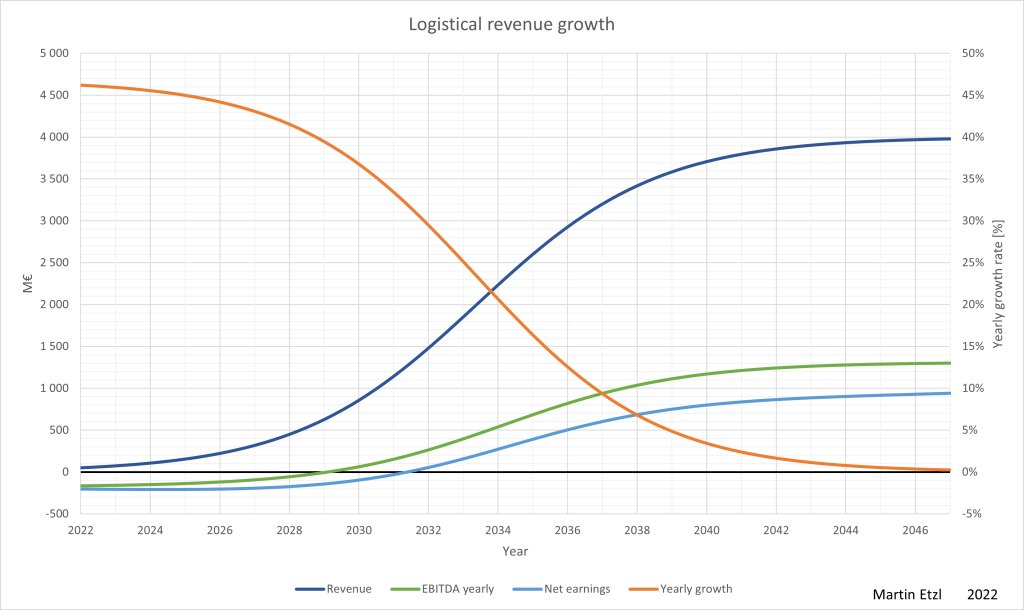

Graph 1 shows the results of the logistic growth model. My model calculates a logistical revenue growth and derives all other metrics from it, depending on the input parameters.

You see the expected development of the revenue, EBITDA and net earnings over several years as well as the deteriorating yearly growth rate.

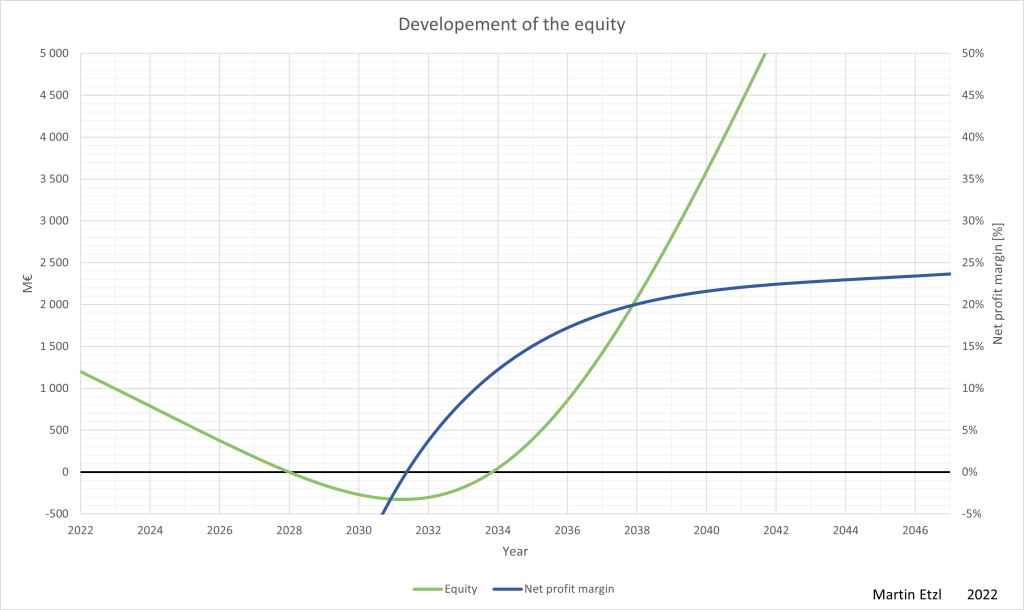

Further results are for example the developement of the equity and the net profit margin, as seen on graph 2. This model does not include corporate actions (dividends, stock issues,…)

What does the result mean for the NPV (Net Present Value)?

It is not just important to know the future prospects of company, but also to know what value I get out of my investment.

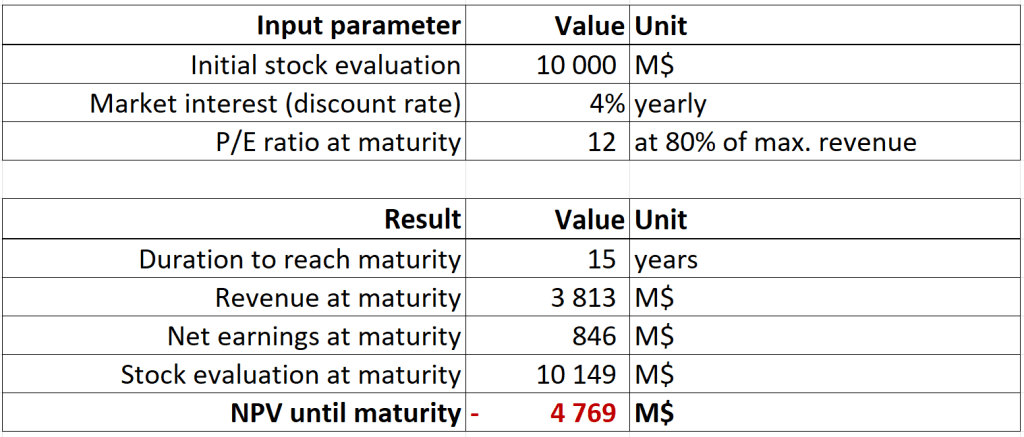

Therefor, the next calculation step of the model is to calculate the NPV. The input parameters are the value of the initial investment, the discount rate and the P/E-evaluation of the company at maturity.

After calculating the NPV, the view on the stock evaluation becomes much clearer for me. In this example, the NPV is negative. In my model, I defined maturity when 80% of the maximum possible revenue is reached.

Finally, I can combine this information with other “soft information” to make a decision whether to invest or not, or to go short in cases of extreme overevaluation.

For sure, this model is a simple model, which does not take into account changing conditions like unexpected competition or changing debt interest rates. Nevertheless, the model gives you a first clue of the future development of a company. One advantage is, that several scenarios can be simulated, evaluated and compared very fast. The analysis of several scenarios is very helpful, as it gives you a good feeling of the susceptibility of the company for changed conditions.

Is it worth the effort, doing this type of analysis for growth stocks, even if I just invest 10.000$ or less?

I evaluated several growth companies before I developed this logistic growth model, and it is extremely difficult even for mathematically well educated and talented people to do calculations. Every attempt by using simpler math, a sheet of paper and a calculator failed to come even close to the results of the logistic growth model. (not to mention the easy to calculate but ridiculously inaccurate PEG-ratio)

Therefore, I love using the model as a first indicator of future value. Furhermore, the model forces me to think about the future revenue, COGS and so on.

In my personal opinion, for a lot of people, it would be already helpful to put as much mental energy into financial investment decisions as they put into the purchasing decision of their next car. Sometimes this applies to me too 😉

Conclusio

There is a lot of uncertainty in all these assumptions we have to make to predict the future. In the end, everything can turn out completely differently due to unexpected events and inaccurate/uncomplete assumptions. What if a competitior introduces a much better substitute? Or, what if the initial success of the company is ephemeral?

However, the uncertainty and complexity should not force us resign at predicting the future. We should use all our abilities to create a better investment decisions and as a result a better tomorrow. It is always advantageous to use a methodology that is more accurate and brings us closer to the truth.

I developed the model further, which you can see here: Advanced growth model