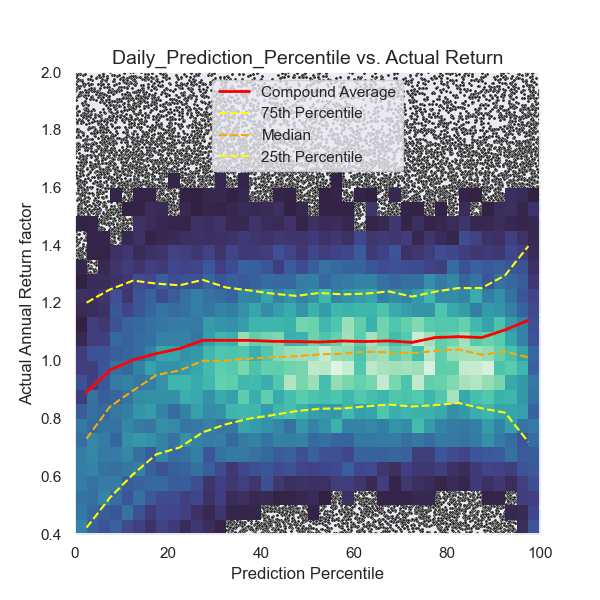

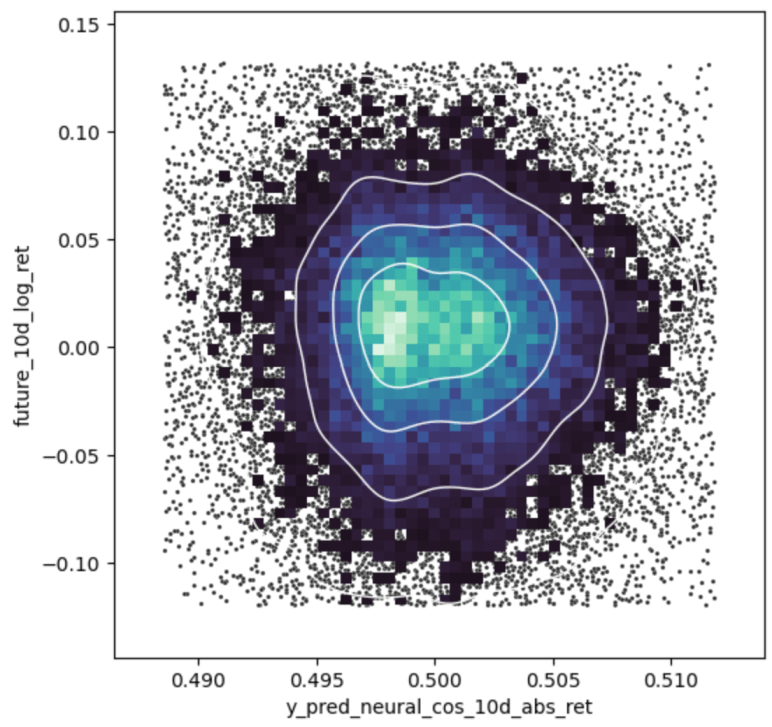

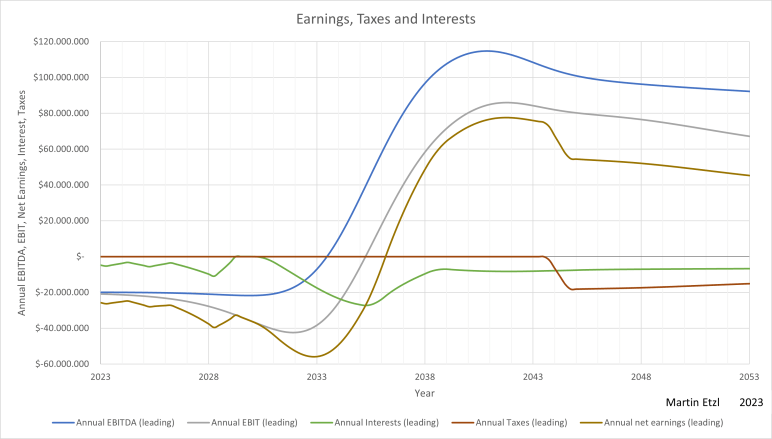

The modern techniques of machine learning are a marvelous gift for processing tabular data and finding patterns, that can be used for predictions. Especially for high dimensional and noisy data where it is not so obvious to see patterns for humans, machines can see them. Not only the possibility to see these patterns, but also … Continue reading Advanced A.I. for stock recommendation